Freight Forwarders Face Rising Port Entry Challenges

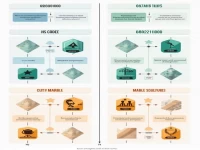

This article delves into common challenges encountered during freight forwarding inbound operations, including bill of lading information verification, shipping company information confirmation, customs inspection, shipper-owned container issues, and the sequence of customs declaration and inspection. It provides corresponding solutions and strategies to help freight forwarders improve work efficiency and reduce operating costs. The focus is on practical problem-solving and offers actionable advice for navigating complex situations in the import process.